do nonprofits pay taxes on donations

For memberships or events there are special rules applicable for memberships and admissions we have pro rules for these type activities too. What Does a Nonprofit Do.

Donations are a critical piece of nonprofit accounting basics.

. Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations. A searchable database of organizations eligible to receive tax-deductible charitable contributions. Profits Who Really Owns a Nonprofit.

However here are some factors to consider when determining what taxes a nonprofit may have to pay. Work performed almost entirely by volunteers Sales of donated merchandise The rental or exchange of donor mailing lists Giving token items to donors in return for contributions Nonprofit Informational Returns. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Nonprofits engage in public or private interests without a goal of monetary profits. First and foremost they arent required to pay federal income taxes. 9 hours agoThe city of Portland Maine raised property taxes on Monday in order to provide more housing for asylum seekers and homeless people WGME reported Tuesday.

Do non profits pay taxes on donations January 3 2022 At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite. A common misconception is that nonprofits cannot earn a profit or pay employees. Nonprofit organizations may be exempt from paying federal income taxes in the US if they meet a certain set of criteria.

Amount and types of deductible contributions what records to keep and how to report contributions. Your recognition as a 501c3 organization exempts you from federal income tax. Are Non-Profits Private or Public Non-profits that are not registered charities may have to file a T2 corporate return if they are incorporated andor an information form T1044.

However this corporate status does not automatically grant. For merchandise Tangible Personal Property TPP rules apply. Your recognition as a 501 c 3 organization exempts you from federal income tax.

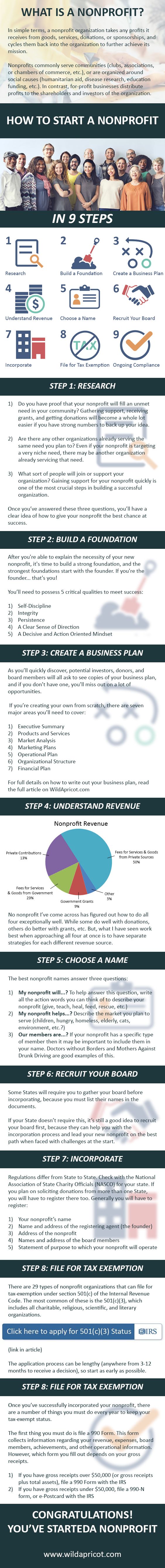

This only applies as long as you spend the money on your. There are 29 different types of nonprofits in the IRS tax code. This may be through offering goods to the community or providing services that are needed by the local population.

Nonprofits are exempt from federal income taxes based on IRS subsection 501 c. Non-taxable nonprofits are attractive to donors and sponsors looking to reduce their personal tax liability meaning nonprofits benefit from being able to raise funds easier when theyre tax exempt. Married filing separately.

They must pay sales tax on all goods and retail services they purchase as consumers such as supplies lodging equipment and construction. Charitable donations are part of your itemized deductions. But if you make a 10000 tax-deductible donation to the government you will only be taxed on the 40000 you have remaining and thus you will only owe the federal government 8000 instead of 10000.

As nonprofit organizations raise funds and solicit donations tracking and properly recording monetary contributions becomes an important function as donors require detailed receipts to. Do nonprofits pay taxes. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of determination to the states Department of Revenue.

How donors charities and tax professionals must report non-cash charitable contributions. Yes nonprofits must pay federal and state payroll taxes. And it doesnt stop there.

There are some instances when nonprofits and churches are still required to pay taxes. If the total of these expenses is more than. The purpose of a nonprofit is to serve the public.

Most nonprofits do not have to pay federal or state income taxes. Other potential deductions include payments for healthcare education property taxes interest on your mortgage and hundreds of additional expenses. The underlying items are taxable or not based on existing state law whether the non-profit vendor is obligated to collect or not.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for. Most nonprofits fall into this category and enjoy numerous tax benefits. But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer.

Do nonprofit organizations have to pay taxes. Many nonprofits are even incorporated. Several different kinds of taxes may apply to your business activities.

In Washington nonprofit organizations are generally taxed like any other business. Normally if you do nothing you will owe the federal government 10000 in taxes. A brief description of the disclosure and.

And there are several types of 501c3. If you want to schedule an event to raise money publicize this fact as it may be an excellent way to draw in donors. A similar anecdote applies to individuals so long as you donate less than 15000 you dont have to pay the gift tax or report anything to the IRS.

In short the answer is both yes and no. The plan will cost the city 9 million. However they arent completely free of tax liability.

Your team can take and record donations right on their phone or mobile device. Unlike a business a nonprofits profit or income beyond expenses does not go to any person or group of people such as owners or stockholders. Notable rules for qualifying as.

What taxes do non residents pay in Spain. They must pay business and occupation BO tax on gross revenues generated from regular business activities they conduct. The fact is that a nonprofit is a type of business.

Common activities that are usually not taxed because they are related to a nonprofits purpose include.

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

Non Profit Creative Sponsorship Levels

Fundraising Infographic Fundraising Infographic A Brief History Of Charitable Giving Visual Ly Charitable Giving Infographic Charitable

Sponsorship Levels Template Check More At Https Nationalgriefawarenessday Com 30307 Sponsorship L Sponsorship Levels Sponsorship Package Sponsorship Proposal

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

Non Profit Budget Template Budget Template Budgeting Budgeting Worksheets

Non Profit Budget Budget Template Donation Letter Template Budgeting

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Non Profit Donations Donation Letter

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Infographic What Is A Nonprofit By Cullinane Law For Any Assistance Related To Legal Aspect Of Nonp Nonprofit Startup Start A Non Profit Nonprofit Marketing

Step By Step Guide To Wrtiing Your Corporate Sponsorship Proposal Sponsorship Proposal Sponsorship Letter Donation Letter

Social Fundraising Tools For Nonprofits Causes Nonprofit Startup Fundraising Marketing Fundraising Activities

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

Nonprofits Need To Have An Excellent Board Nonprofit Information Fundraising Methods Personal Fundraising Fundraising

Sponsorship Levels Sponsorship Levels Event Sponsorship Sponsorship Letter